Climate-Related Disclosure Based on TCFD Recommendations

The Nichiban Group Philosophy is to “respect people’s cooperative relationships and strive to foster prosperity and happiness for all stakeholders.” In line with this philosophy, in order to meet stakeholder expectations and the demands of society, we have defined materiality in our “Concept of Sustainability” and have identified climate change and global warming countermeasures as our highest priorities.

The Nichiban Group discloses information based on the four pillars recommended by the Task Force on Climate-related Financial Disclosures (TCFD): Governance, Strategy, Risk Management, and Metrics and Targets. We will continue to enhance these disclosure efforts going forward.

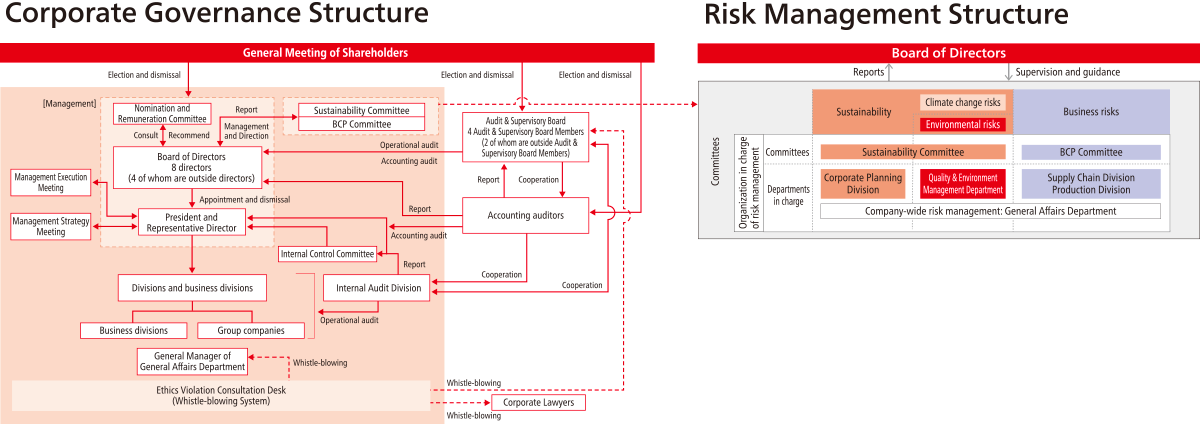

1. Governance

- The Sustainability Committee, chaired by the Director in charge of CSR, is established to review and deliberate basic policies, important issues, and risks and opportunities related to climate change.

- Climate change-related studies are conducted under the auspices of the Sustainability Committee, which submits and reports its findings to the Board of Directors once a year, with the Board of Directors providing oversight and guidance.

- Agenda items deliberated and resolved by the Board of Directors are implemented in each division and reflected in their respective management plans and business operations.

2. Strategy

- Perceiving climate change as one medium- to long-term risk facing the Nichiban Group, and to consider strategies and organizational resilience in light of related risks and opportunities, we referred to climate change scenarios (<2°C scenario and 4°C scenario*) proposed by the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC) to consider the long-term impact on Nichiban up to 2050, and conducted scenario analyses for our domestic medical and tape businesses, which account for a large portion of sales.

- Note:

The <2°C scenario assumes measures such as tighter regulations and market changes are implemented to minimize temperature increases.

The 4°C scenario assumes rising temperatures will result in extreme weather and other physical impacts.

3. Risk management

- Nichiban established a working group on climate change risks to conduct scenario analysis. To prioritize climate-related risks, we will focus efforts on key risk factors, taking into consideration the likelihood of occurrence and magnitude of impact that risks and opportunities have on Nichiban. The Sustainability Committee will continuously confirm these risk factors going forward.

- As a process for managing climate-related risks, the Corporate Planning Division serves as the secretariat for the Sustainability Committee, analyzing climate-related risks, formulating and promoting countermeasures, and managing progress through the Sustainability Committee.

- The details analyzed and reviewed by the Sustainability Committee are reported to the Board of Directors for Company-wide integrated risk management.

| Scenario | Factor | Change | Risk/Opportunity | Degree of impact | Impact on Nichiban | Nichiban countermeasures |

| 2°C (Transition) | Introduction of carbon taxes. | Increased procurement costs for raw materials and secondary materials. | Risk |  |

Profits will be squeezed by passing on the cost of raw materials and secondary materials such as FSC®-certified paper, resin, and rubber, which have high emissions per unit. | Reduce procurement costs and pass on costs by strengthening procurement functions through procurement conditions and supplier revisions, etc. |

| Increased operating costs. | Risk |  |

Carbon taxes will put downward pressure on profits. | Reduce energy consumption by reorganizing production bases and introducing new construction methods. | ||

| Strengthening of various regulations including GHG emission regulations. | Increased operating costs due to purchase of certificates and other environmental value. | Risk |  |

Increased costs of purchasing certificates, etc., will put downward pressure on profits. | Reduce purchase costs through price negotiations for environmental value and diversification of suppliers. External PR focused on renewable energy initiatives. |

|

| Increase in facility upgrade costs. | Risk |  |

Increased financial burden due to new capital investments for decarbonization (achieving CO2 emission targets) and restructuring of production bases will put downward pressure on profits. | Reduce costs by introducing comprehensive determination criteria for CO2 emissions and environmental impacts. Level capital investments, etc., based on long-term investment plans. |

||

| Growing awareness of environmental considerations. | Growing demand for natural products. | Opportunity |  |

We can expect an increase in the domestic sales of products derived from natural materials in the fields of home offices, e-commerce, and industrial products (results of impact estimates as of fiscal 2023). | Intend to improve brand value by appealing the environmental contribution value of products made from naturally derived materials (cellulose tape, etc.) | |

| Increased demand for environmentally friendly products. | Opportunity |  |

By quantifying the environmental life cycle impact from procurement, design, and manufacturing, we will increase sales by promoting switching through the development and strengthening of sales of products with high environmental value. | Promote Nichiban initiatives for material sustainability issues • Promote product development and strengthen sales of environmentally friendly products • Introduce low environmental impact evaluation into product development |

||

| Investor emphasis on ESG. | Growing importance of addressing climate change and disclosure | Risk |  |

Delays in disclosing information on efforts to address climate change, etc., will lead to lower investor evaluations. | Maintain implementation of appropriate climate change initiatives and information disclosure | |

| 4°C (Physical) | Increased frequency of severe disasters. | Increased demand for tapes and sheets for disaster prevention, repair, and temporary fixes. | Opportunity |  |

Sales of tape products used for disaster prevention, etc., will increase. | Develop and promote sales of products that prepare for severe disasters. |

| Increased risk of temporary production stoppages due to disasters. | Risk |  |

The results of the Aqueduct floods rcp8.5 scenario analysis confirmed that none of these scenarios are damaging at this time. | Ongoing response through established Business Continuity Plan (BCP). | ||

| Decrease in production of raw materials derived from natural resources due to climate change. | Increased risk of production stoppages. | Risk |  |

Profits will be adversely impacted by production stoppages due to difficulties in procuring materials necessary for production. | Diversify raw material suppliers. |

4. Metrics and Targets

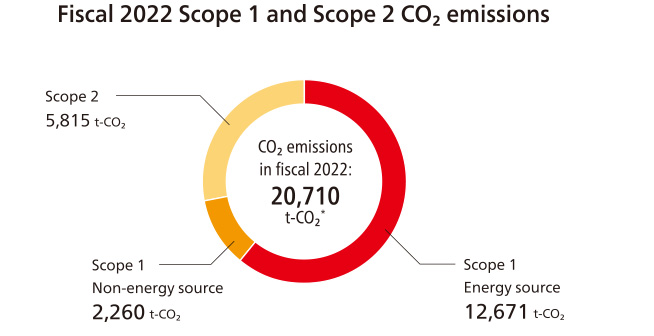

- In order to assess and manage the impact of climate-related issues on management, we use total greenhouse gas (GHG) emissions (CO2) falling under Scope 1, Scope 2, and Scope 3, as an indicator.

- Targets and results for Scope 1, Scope 2, and Scope 3 are disclosed for Nichiban and its domestic subsidiaries.

- In addition to existing efforts, major CO2 emissions reduction efforts will be studied and sequentially disclosed in light of cost and effectiveness in order to contribute to a decarbonized society.

| FY2022 | FY2030 | FY2050 |

|---|---|---|

| Scope 1 and 2 emissions are 20,710 [t-CO2] *1 |

Reduce CO2 emissions in Scope 1 and 2 by 40%(compared with FY2013) | Reduce CO2 emissions in Scope 1 and 2 by 100%(compared with FY2013) |

- Total emissions 25,705 [t-CO2]

- Amortization from green electricity certificates 4,995 [t-CO2]

- Actual emissions 20,710 [t-CO2] *1

- *

Excludes amount equivalent to green electricity from Green Power Certificates (4,995 tons of CO2).

Scope1,2 CO2 emission transition (figures after deduction of green electricity equivalent of Green electricity Certificates)

| FY2021 | FY2022 |

|---|---|

| 22,620 [t-CO2] | 20,710 [t-CO2] |

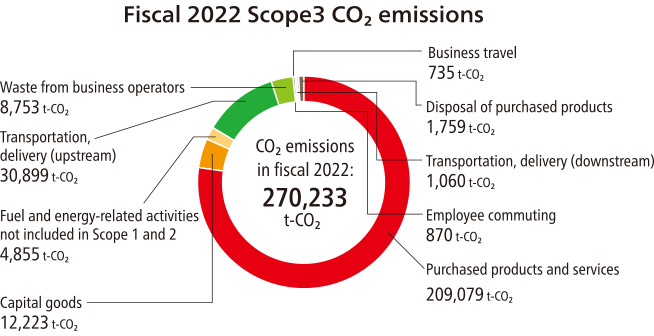

FY2022 Scope3 CO2 emissions

| Category 1 | Purchased products and services | 209,079 | |

| Category 2 | Capital goods | 12,223 | |

| Category 3 | Fuel and energy-related activities not included in Scope 1 and 2 |

4,855 | |

| Category 4 | Transportation, delivery (upstream) | 30,899 | |

| Category 5 | Waste from business operators | 8,753 | |

| Category 6 | Business travel | 735 | |

| Category 7 | Employee commuting | 870 | |

| Category 8 | Upstream leased assets | - | |

| Category 9 | Transportation, delivery (downstream) | 1,060 | |

| Category 10 | Processing of sold products | - | |

| Category 11 | Use of sold products | - | |

| Category 12 | Disposal of purchased products | 1,759 | |

| Category 13 | Downstream leased assets | - | |

| Category 14 | Franchises | - | |

| Category 15 | Investments | - | |

| Scope3 | 270,233 | ||