Message from the Financial Officer

Please review the consolidated results for the fiscal year ended March 2023.

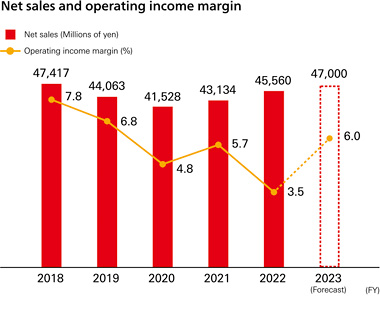

For the fiscal year ended March 2023, we posted higher revenues but a decline in operating income, with net sales of ¥45,560 million (up 5.6% year on year), operating income of ¥1,609 million (down 34.3%), ordinary income of ¥1,748 million (down 31.8%), and net income attributable to owners of parent of ¥2,731 million (up 31.0%). Sales of such mainstay products as CARELEAVES™ and the ROIHI series grew steadily thanks to strengthening capabilities of our EC business and a recovery in inbound demand. In addition, our overseas business grew in both Asia and Europe thanks in part to a weaker yen, and the ratio of overseas sales reached 10.1% (8.1% in the previous fiscal year).

In terms of profit, however, the main drivers of the significant drop in operating income were the sharp rises in raw material and energy prices as well as higher foreign currency-denominated procurement costs caused by the yen’s depreciation. These led to a substantial deterioration in the cost of goods sold ratio. These factors had a particularly big impact on industrial and stationery tape products in general, while the effects of our price revisions are still in the emerging stages. Net income rose markedly due to booking a gain on the sale of land previously occupied by the former Osaka Factory in Japan, as initially planned.

Please look back on Nichiban’s earnings and financial position to date.

Four years have elapsed since the start of the current medium-term management plan (five-year) in the fiscal year ended March 2020. Both sales and profits are expected to fall short of the initial plan due to weak earnings caused by the COVID-19 pandemic and higher costs, which we had not anticipated at the time the plan was formulated. The ROIHI series, which is a key earnings driver and popular in South Korea and other countries, was particularly affected by the contraction in inbound demand. The industrial and stationery tape business also faced a challenging situation due to the timing of investments for renewal of aging facilities and environmental measures (e.g., desolventization), compounded by soaring raw material and energy prices and the impact of production volume adjustments due to shortages of semiconductors. As such, the downturn in earnings is largely attributable to external factors. That said, we have been unable to change our profit structure at the level of innovation, which is still dependent on our existing mainstay products. We recognize that transforming our business portfolio remains an issue for the future. On a brighter note, the overseas business, which is positioned as a growth engine for the medium to long term, has been growing steadily as its bases in Thailand and Germany are on track.

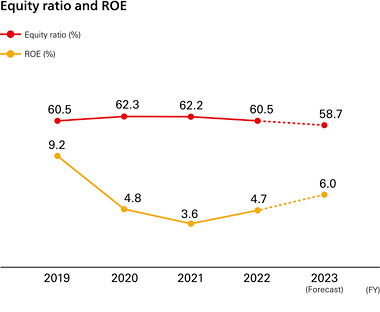

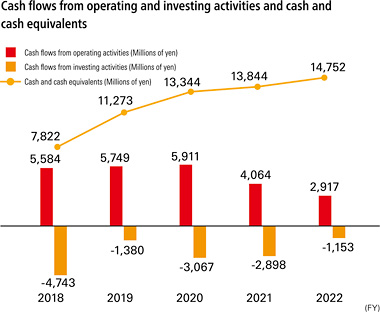

In financial terms, in line with our initial plan, we have proactively invested in growth and made environmental investments in anticipation of the future, as well as in maintaining our production capacity and replacing our enterprise systems. Although total assets are on an increasing trend, due in part to the need to secure inventory as a contingency for supply chain disruptions, cash flows from investing activities are within the scope of cash flows from operating activities, and our equity ratio is stable at around 60%. We view our strong financial base and high level of liquidity on hand as a driving force for sustainable growth. However, ROE, which is a measure of capital efficiency, has remained weak due to slow growth in net income, and we have not achieved our target of 10%.

Please share Nichiban Group’s financial policy and your views on financial risks.

We will continue to invest in growth areas such as medical products, digital transformation (DX) investment to improve productivity and utilize data, and environmental investment to reduce the use of solvents, as well as to achieve the strategies of “Creating Innovation” and “Global Expansion” as stated in our medium- to long-term vision. In particular, we are considering capital and business alliances, including M&A with local partners to expand our overseas business, as we will need not only sales but also production and distribution bases.

Let me add that, our financial policy, which has held up under various challenges since our founding, is based on maintaining a solid financial foundation, and we intend to invest while adhering to a set level of financial discipline, such as ensuring an appropriate equity ratio and liquidity. We also focus on capital efficiency. In addition to continuing to enhance shareholder returns, we aim to improve ROE through profit growth based on sales growth and improvement of operating margin ratio as KPIs. Therefore, while price revisions to cope with rising raw materials costs and the growth of high-margin medical products will support the improvement in profitability for the near term, we believe new businesses and expansion of overseas businesses will be important earnings drivers in the medium to long term.

As for financial risks, the downside risk to Nichiban’s earnings is relatively limited due to the fact that our products are mainly necessities for daily life. Nonetheless, as with other manufacturers, we need to monitor the impact of sharp cost hikes and exchange rate fluctuations,

as well as concerns about obstacles to debt collection and procurement of materials due to economic recession and supply chain disruptions. Looking ahead, we may have to pay attention to the risk of impairment losses on goodwill associated with M&A and on expanded production facilities and other assets. Our aim is to maintain financial soundness while making appropriate investment decisions and practicing prudent risk management.

What are the consolidated forecasts and underlying assumptions for the fiscal year ending March 2024?

We are forecasting an increase in both sales and operating income for the fiscal year ending March 2024, with net sales of ¥47,000 million (up 3.2% year on year), operating income of ¥2,800 million (up 74.0%), ordinary income of ¥2,900 million (up 65.9%), and net income attributable to owners of parent of ¥2,100 million (down 11.4%).

We expect sales growth to be driven by continued expansion in the healthcare products business due to increased inbound demand, an ongoing shift to EC business, a recovery in the industrial products sector, and expansion of overseas business. On the profit front, although raw material prices are expected to remain high, we are projecting an upturn in operating income by as the sales price revisions from the previous fiscal year gain further traction.

Please explain Nichiban’s thinking with regard to shareholder returns.

Nichiban’s policy is to continue to pay dividends linked to business performance, with a target payout ratio of about 25% (consolidated), based on the premise of delivering stable dividend payments. Despite the impact of an unexpectedly high cost of sales, we paid an annual dividend of ¥35 per share (payout ratio of 30.5%) for the fiscal year ended March 2023, as initially planned. For the fiscal year ending March 2024, we plan to pay an annual dividend of ¥35 per share (payout ratio of 34.5%), the same as the previous fiscal year.